The Refurbishment Market in 2025

The refurbishment market is experiencing impressive growth and continues to surprise with its innovations.

The Refurbishment Market in 2025: State of Play

In 2025, the refurbishment market is establishing itself more than ever as a pillar of the circular economy. Giving our products a second life is no longer a marginal practice: it has become a reflex for many consumers and businesses.

This evolution responds to urgent environmental concerns:

- Reduction of electronic and textile waste

- Preservation of natural resources

- Decrease in carbon footprint

It also fits into major economic issues:

- Declining household purchasing power

- Component shortages in industry

- Search for sustainable and affordable alternatives

Result: the refurbished market is experiencing sustained growth in various sectors. From electronics to home appliances, through computing and textiles, all segments are concerned.

But where exactly are we in 2025?

This article reviews:

- The new trends of the year

- Technological innovations transforming the sector

- Medium-term perspectives

- Challenges for professionals

Let's discover together this ongoing revolution, in a human and concrete way.

Evolution of the refurbishment market: from niche to new norm

Refurbishment has come a long way in recent years. From a once confidential practice, it has moved to the general public.

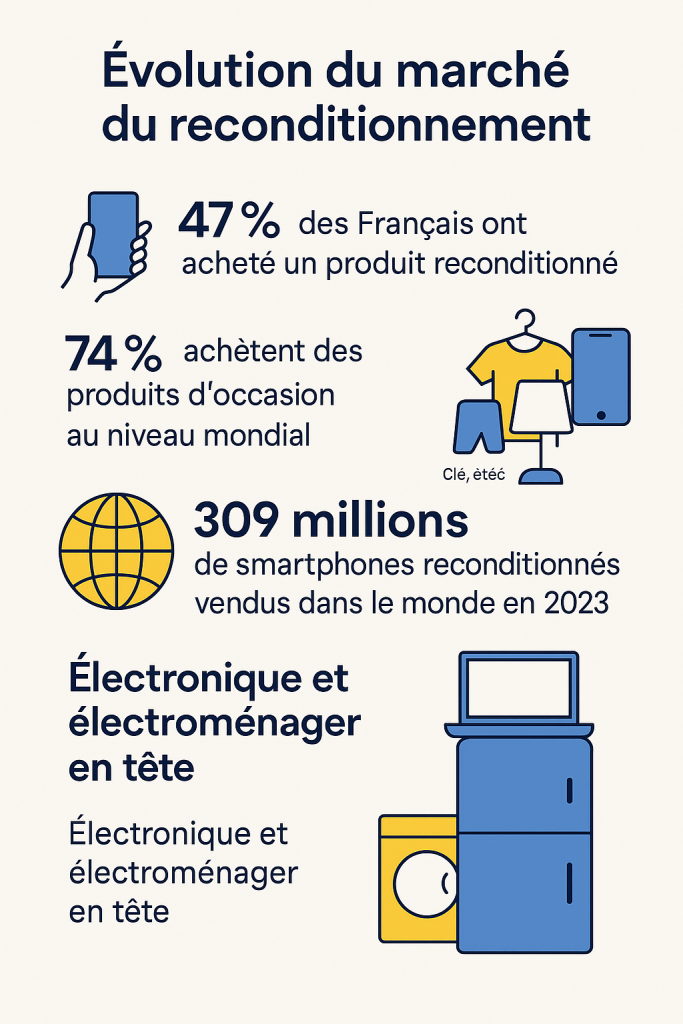

The figures speak for themselves. More than 47% of French people have already bought at least one refurbished product, most of the time motivated by the more accessible price compared to new.

And this phenomenon is global: a recent study indicates that 74% of consumers worldwide now buy second-hand products, with clothing, electronics and home items being the flagship categories (commerce.orisha.com).

In other words, buying refurbished or second-hand is now common and socially valued, far from the image of "emergency solution" of yesteryear.

Electronics at the forefront

All product categories benefit from this enthusiasm. The electronics and computing sector remains at the forefront. The refurbished smartphone market shows impressive volumes: more than 309 million refurbished smartphones were sold worldwide in 2023.

In France, this corresponds to approximately one phone in five in circulation.

Laptops and tablets follow the same trajectory, with double-digit growth in sales in recent years. This growth is driven by:

- Consumers looking for technological bargains

- Companies concerned about reducing their costs

- Adoption of sustainable practices by organizations

The home appliance sector is also embracing refurbishment. Far from being anecdotal, the market for refurbished household appliances is experiencing notable progress.

Whether it's giving a second life to a refrigerator or a washing machine, more and more retailers are offering refurbished appliances.

In France, major distributors have launched dedicated offers:

- "2nde Vie" at Fnac Darty

- "Reconomia" at Electro Dépôt

These initiatives testify to real and growing demand.

Textiles and fashion in full boom

Consumers appreciate being able to equip themselves with quality home appliances at lower cost, while reducing waste.

This awareness is reflected in studies: according to Gartner, more than 70% of consumers now consider refurbished products as a viable alternative to new products.

Once reserved for small appliances, refurbishment now also affects large equipment, boosted by the attraction for savings and ecology.

Textiles and fashion form another crucial part of this evolution. Refurbished fashion, or more broadly second-hand textiles, is in full boom.

Spectacular growth of refurbished textiles

This global market is expected to reach $77 billion by the end of 2025, with growth 11 times faster than that of the traditional clothing market.

Consumers, especially younger ones, are massively turning to second-hand or refurbished clothing to reconcile:

- Personal style

- Controlled budget

- Ecological convictions

Each purchase of refurbished clothing saves resources and reduces the carbon footprint of the fashion industry.

Major brands have understood this: they are increasingly launching resale platforms or "second-hand" collections.

What was once a niche trend (thrift stores) has become a groundswell movement. In fact, analysts even predict that the second-hand fashion market could soon exceed that of traditional fast fashion if the trend continues.

New notable trends in 2025

In 2025, several new or recently accelerated trends are shaping the refurbishment market.

First, **refurbished is becoming a common purchasing reflex**. Economic uncertainty (inflation, constrained purchasing power) pushes consumers to seek the best value for money.

Buying refurbished allows you to afford a high-end product at a reduced price. Thus, even audiences previously hesitant are getting into it.

For example, more and more parents are offering their teens refurbished smartphones rather than new ones, combining savings and ecological education.

Next, we observe increasing involvement from traditional brands. For a long time, the second-hand and refurbished market has been dominated by pure players (specialized online platforms).

Now, manufacturers and historical distributors want their share of the pie. Many are launching buyback and resale programs for their own products.

In electronics, giants offer refurbished iPhones or game consoles certified by their care.

In fashion, retailers create second-hand spaces in stores or online to resell items from previous collections.

Official integration of refurbished

This integration of refurbished into brands' official offerings is a strong trend in 2025: it reassures consumers and brings credibility to the refurbishment market. In return, brands gain loyalty and a responsible image.

Consumers and their behavior

Meanwhile, consumer behavior continues to evolve. Buyers in 2025 are better informed and more demanding.

They compare, read warranties, check quality grades of refurbished products. Trust has been established through warranties and positive feedback.

However, consumers expect impeccable service:

- Flexible return policy

- Minimum one-year warranty

- Transparency about the product's condition

Sector players have understood this and are constantly improving the customer experience around refurbished products.

Dedicated after-sales service for refurbished products is becoming a standard. This professionalization responds to a need: even second-hand, we want like new.

Finally, let's note the rise of new categories of refurbished products. While electronics and fashion paved the way, 2025 sees the extension of the concept to other areas.

| Sector | Product Examples | Trend |

|---|---|---|

| Professional IT | Servers, enterprise PCs | Strong growth |

| Soft mobility | Electric bikes, electric scooters | Emerging |

| Luxury | Luxury bags and watches with certification | Premium niche |

Refurbished professional IT equipment is booming to allow companies to equip themselves at lower cost.

The soft mobility sector is also getting involved: we now find refurbished electric bikes, verified second-hand electric scooters.

Even luxury is interested in the phenomenon: specialized sites offer refurbished luxury bags and watches with authenticity certification.

In short, everything that can be refurbished finds buyers. This diversification testifies to the maturity reached by the refurbishment market in 2025.

Technological innovations: AI, automation and reverse logistics

The rise of refurbishment is accompanied by major technological innovations that revolutionize processes.

In 2025, artificial intelligence (AI) and automation have become precious allies for giving products a second life.

For example, AI is increasingly used to diagnose device failures and optimize repairs.

AI in service of diagnosis

Algorithms analyze malfunctions of a smartphone or computer in minutes, guide technicians toward components to replace, and even predict the remaining lifespan of the product.

This technological assistance brings several advantages:

- Reduction of refurbishment time

- Reliability of the refurbishment process

- Optimization of repair costs

Furthermore, AI serves to automatically classify the aesthetic condition of a device (scratches, wear) via computer vision, in order to assign it a grade rating (Grade A, B, C) consistently.

Automation also enters the scene in refurbishment workshops. Robots and specialized machines take charge of repetitive or delicate tasks.

For example, robotic arms can calibrate and replace smartphone screens with surgical precision.

In home appliances, we see automated disassembly and sorting lines for parts:

- Still functional components are recovered

- They are automatically tested

- Then reassembled on other units

These robotic processes increase processing volumes while reducing human errors. They make it possible to envision the industrial scaling of refurbishment, essential to meet growing demand.

Reverse logistics

Another key technological axis in 2025 is **reverse logistics**.

This term designates the entire organization put in place to:

- Recover used products from consumers

- Transport them to refurbishment centers

- Redistribute refurbished products

Long a weak point of the sector, reverse logistics is becoming more agile and efficient thanks to technology.

Companies deploy intelligent tracking systems to trace each returned product, from its collection point to its return to stock.

Dedicated software platforms manage flow optimization:

- Coordination of carriers

- Management of transit warehouses

- Minimization of processing times

Logistics automation also helps sort products upon arrival:

- Barcode or serial number scanning

- Automatic recording of declared product condition

- Orientation toward the right channel (repair, recycling, donation if not refurbishable)

Thanks to these advances, the refurbishment chain gains speed and profitability.

Emerging technologies: IoT and Blockchain

Technologies like the Internet of Things (IoT) and blockchain are beginning to bring innovative solutions:

- IoT: via sensors integrated into equipment, can send alerts when a device needs maintenance or reaches the end of its first life cycle

- Blockchain: offers enhanced traceability possibilities with an unfalsifiable "digital passport" accompanying each refurbished product

These technological innovations, once futuristic, are becoming tangible in 2025. They contribute to:

- Reducing refurbishment costs

- Improving the quality of finished products

- Strengthening consumer confidence in these channels

Medium-term growth prospects for the refurbishment market

The medium-term prospects of the refurbishment market (2025-2030 horizon) appear extremely promising.

All indicators suggest that growth will continue, even accelerate, in the coming years.

Refurbished smartphone market projections

Taking the example of second-hand smartphones (refurbished or resold), the IDC firm estimates that this global market, valued at approximately $65 billion in 2023, could reach nearly $110 billion by 2027.

By volume, this would represent more than 430 million units exchanged in 2027, a spectacular leap that illustrates the magnitude of the phenomenon.

And remember that this is only smartphones: other segments like consumer electronics or home appliances should also experience sustained expansion globally.

According to Statista, demand for refurbished products will continue to increase in these growth sectors, driven by:

- Growing environmental awareness

- Economic attractiveness of these sustainable alternatives

In Europe, public policies support these prospects. The European Union strengthens its directives in favor of repair and reuse each year:

- Right to repair

- Repairability indices

- Waste reduction objectives

These measures encourage manufacturers and distributors to integrate refurbished into their business model, under penalty of sanctions or losing market share to increasingly discerning consumers.

The emergence of new offers

We can therefore expect new refurbished offers to constantly emerge, including in unexpected sectors.

In the medium term, refurbished could become as common a reflex as buying new, even gradually supplanting the latter in certain categories where "like new" amply meets needs (tech, fashion, etc.).

Some projections go even further, imagining a future where the share of second-hand exceeds that of new in several markets.

Without going to these extremes, one thing is certain: the growth of refurbishment is here to stay.

Investors have understood this, injecting capital into:

- Sector startups

- High-tech refurbishment factories

- Circular commerce platforms

Consumers, meanwhile, show stable and increasing purchase intentions for refurbished from year to year.

For example, more than half of French people now plan to buy a refurbished device in the coming months (smartphone, home appliance or other), according to the latest polls.

By 2030, we can envision a much larger, better structured refurbishment market, firmly anchored in responsible consumption habits.

Opportunities and challenges for brands and professionals

For businesses and professionals, the rise of the refurbishment market opens considerable opportunities while posing new challenges.

Opportunities side

Refurbished allows brands to diversify their offering and reach a wider clientele. Offering refurbished products means:

- Attracting consumers looking for good deals

- Appealing to customers engaged in an ecological approach

- Expanding the customer base

It's also a way to retain the customer base: by offering a second life to products, the brand stays in contact with the buyer throughout the entire life cycle, instead of losing them after the initial sale.

Furthermore, marketing refurbished products generates new revenue while capitalizing on dormant stock or returns. It's a virtuous economic and ecological circle.

Let's also note that engaging in refurbishment improves brand image in terms of CSR (Corporate Social Responsibility): the company positions itself as a responsible and innovative player, which is increasingly appreciated by consumers.

And the challenges?

The **challenges** should not be overlooked.

The first challenge is **the quality and reliability** of refurbished products. Consumers expect the "like new" product to work perfectly.

The slightest failure can tarnish the trust given to the brand or the entire sector.

It is therefore imperative for professionals to implement rigorous processes for quality control, testing and certification.

Absolute quality requirement

Each refurbished device must be meticulously checked. This requires know-how, time and sometimes replacing certain parts, hence a cost that must be controlled to remain profitable.

Another major challenge lies in refurbishment logistics. Collecting used products, sorting them, transporting them to processing centers, then redistributing refurbished products involves a complex and expensive supply chain.

Optimizing this reverse logistics is essential to generate sufficient margins. Professionals must invest in:

- Adapted infrastructure

- Logistics partnerships

- Specialized software to efficiently orchestrate these flows

Summary: opportunities vs challenges

| Opportunities | Challenges |

|---|---|

| New markets and customer segments to conquer (e.g. refurbished textiles expanding) | Guarantee impeccable quality of refurbished products to maintain trust |

| Source of additional revenue and increased customer lifecycle (resale, buyback services) | Implement efficient and low-cost reverse logistics (collection, storage, repair, redistribution) |

| Brand image reinforcement through sustainable and innovative positioning | Adapt internal organization (technical training, dedicated customer service, spare parts management) |

Taking advantage of opportunities

Fortunately, professionals are not alone in meeting these challenges. Technological and software solutions are emerging to support refurbishment management.

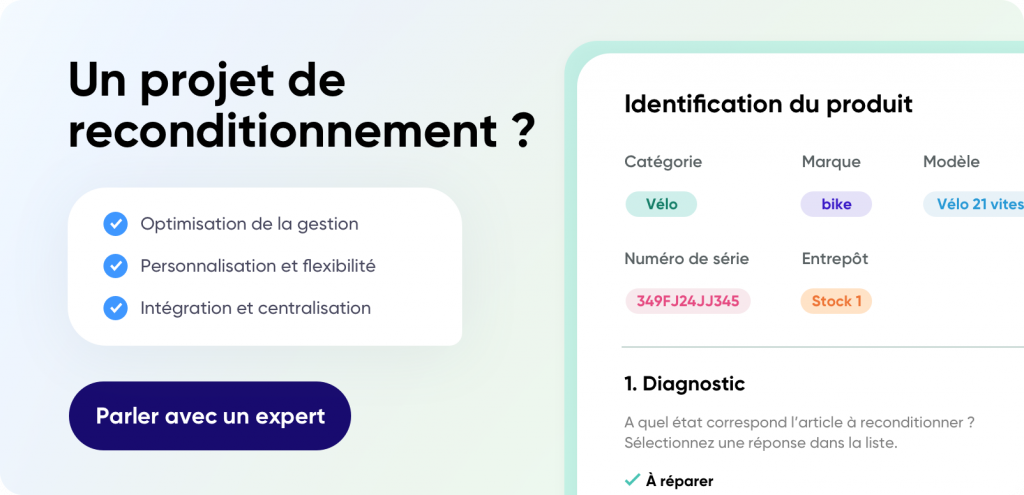

For example, specialized platforms like ZIQY Refit allow companies to manage the entire refurbishment process in a centralized and automated way, from product recovery to resale.

Integrated technological solutions

By equipping themselves with such tools, a brand can:

- Track the status of each returned product in real time

- Optimize repair operations through algorithms

- Manage its refurbished inventory

- Connect its refurbished product catalog to online sales channels

This type of innovation greatly facilitates the deployment of a large-scale refurbishment strategy.

The refurbishment market in 2025 is both dynamic, innovative and meaningful. What was initially just a punctual response to crisis (economic or ecological) is becoming permanently established in our consumption patterns.

Refurbished products offer a concrete response to the challenges of our time: consuming better, making objects last longer, without sacrificing budget or the planet.

For companies, it's the opportunity to reinvent their offering and build a more circular and resilient model. Of course, obstacles remain to overcome, but the momentum is there.

In 2025, the refurbishment market is no longer an emerging trend, with solid growth prospects and mass adoption by consumers.

It's up to all of us, as economic actors and citizens, to continue to keep this dynamic alive so that it keeps its promises in the medium and long term. The coming years look exciting for refurbished, and it's up to us to actively participate in it.

updated on April 30, 2025

Related Articles

Nearshoring and refurbishment: 2025 logistics revolution

Global trade reaches historic heights with $35 trillion in exchanges in 2025, according to the latest projections...